The Ai Platform for Property, Owner, Investor & Lender Intelligence.

Leverage nationwide coverage, predictive scoring, and tailored insights to find the best opportunities, connect with the right people, and move faster in any market.

Our proprietary platform combines massive data coverage with advanced predictive modeling to deliver actionable intelligence that drives business growth.

Access to 240M+ households, 150M+ properties, 18.4M+ investors, and 122K+ lenders across all U.S. markets.

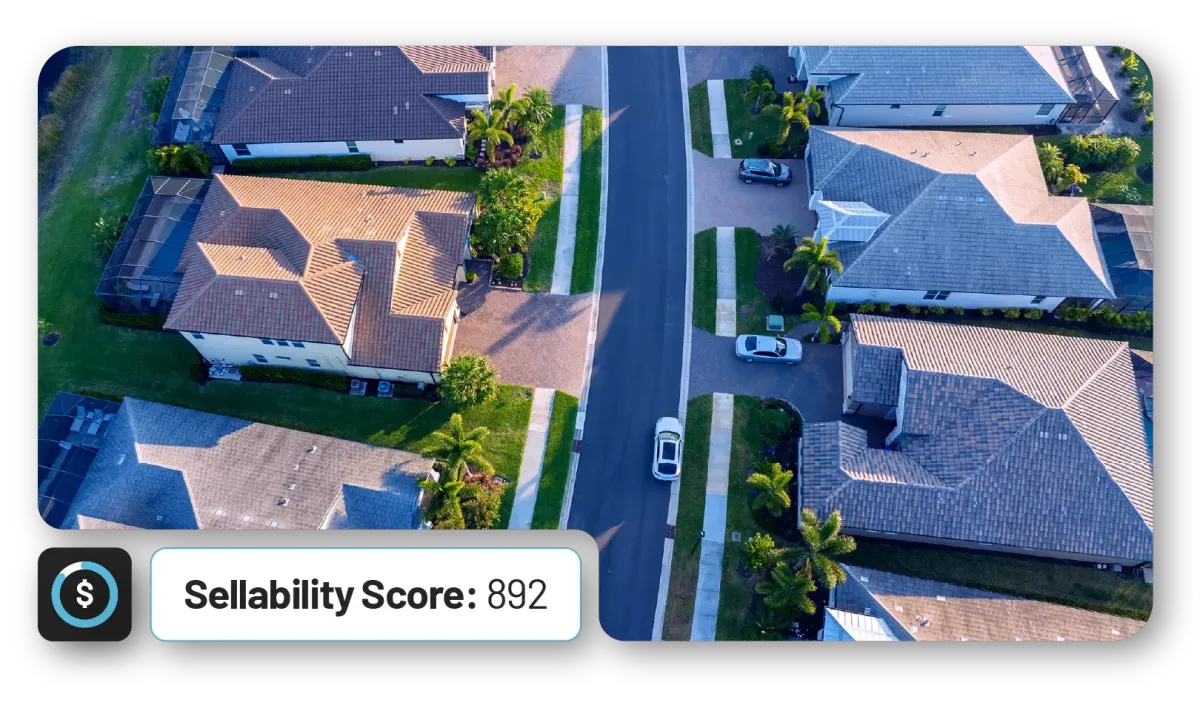

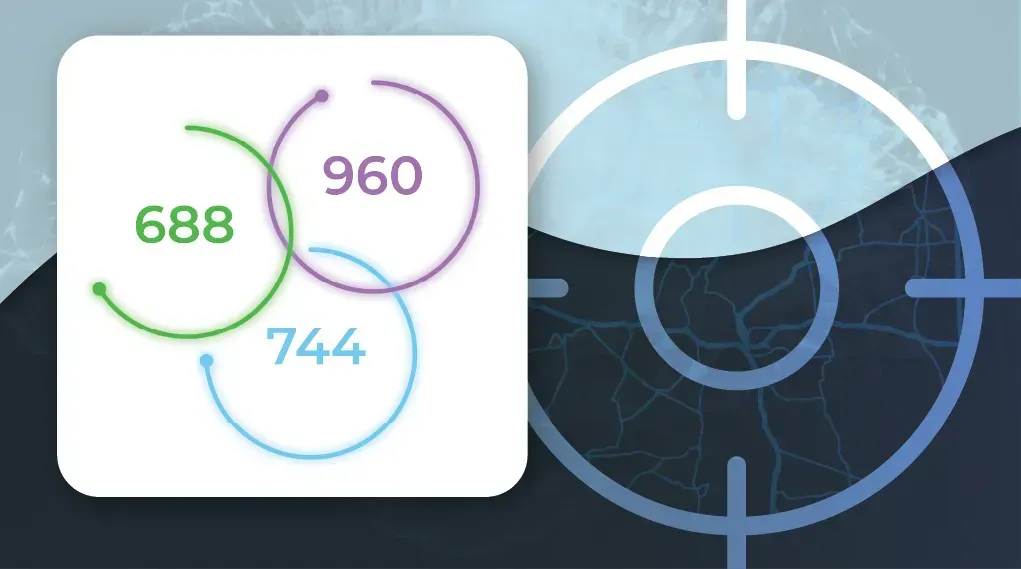

Proprietary algorithms that predict sellability, investor activity, liquidity events, and other high-value opportunities.

Seamlessly integrate with your existing systems via API, SFTP, or access through our secure portal.

Built on public and licensed non-credit data without credit bureau information or live tracking.

Four Products. One Data Engine.

Our suite of specialized tools addresses your unique data challenges while leveraging our proprietary nationwide dataset.

Industry Solutions Without Limits.

Six featured verticals plus fully customizable solutions for any market connected to property, ownership, or capital.

How advanced property intelligence accelerates deployment and reduces risk for institutional investors.

Get 90–180 days of pre-market visibility, target only the assets that move, and deploy faster with confident, compliant signals.

Fill out the form to download for free!

Our platform delivers measurable results through a combination of data expertise, predictive intelligence, and seamless integration.

Our proprietary cleansing algorithms and business rules ensure unmatched accuracy in property intelligence. We've refined our methods over two decades to deliver the cleanest, most actionable data in the industry.

Our back-tested Ai models improve targeting, precision, and timing. By analyzing historical patterns and market indicators, we help you identify opportunities before your competitors.

No list stitching or data gaps - just complete visibility across all U.S. markets. Our comprehensive coverage allows you to scale initiatives nationally with confidence.

Start with targeted campaigns and scale based on measurable ROI. Our flexible implementation model lets you validate results before full deployment.

Flexible delivery options designed to fit your existing tech stack. Whether through API, SFTP, or our secure portal, implementation is straightforward and efficient.

Our clients consistently outperform their competition with Scope Ai-powered intelligence.

Here's what our data can do for your business:

Retail and home services companies achieve 40% greater efficiency in targeted marketing campaigns by identifying high-propensity households.

Insurance providers experience 20% improvement in policyholder retention by identifying and addressing at-risk customers before they churn.

Investment firms double their pre-market property acquisitions by identifying motivated sellers before properties are publicly listed.

Luxury brands increase their conversion rates by 25% through precise targeting of high-net-worth property owners likely to purchase premium products.

Results based on modeled outcomes using historical data patterns and industry benchmarks.

Scope Ai powers growth strategies across diverse industries, each with unique data challenges and opportunities.

Identify profitable policyholders, reduce churn, and optimize underwriting with property and owner intelligence.

Enhance your platforms with robust property data and intelligence through our flexible API solutions.

Connect with affluent property owners for targeted premium product and service marketing.

Target high-propensity households ready for home improvements, appliance upgrades, & services.

Source off-market properties, identify motivated sellers, and optimize portfolio performance.

Identify qualified borrowers and optimize lending criteria with property-based intelligence.

Schedule a personalized demo to see how Scope Ai can transform your approach to property, owner, investor, and lender intelligence.