Key Industry Challenges

Unexpected Churn

Policyholders move or switch providers without warning.

Claims Leakage

Inaccurate property condition data leads to underpricing and unexpected payouts.

Inefficient Marketing

Broad campaigns waste spend on low-propensity prospects.

Risk Blind Spots

Incomplete data on property condition, equity position, or owner status.

Compliance Requirements

Need compliant, non-credit data sources with proven accuracy.

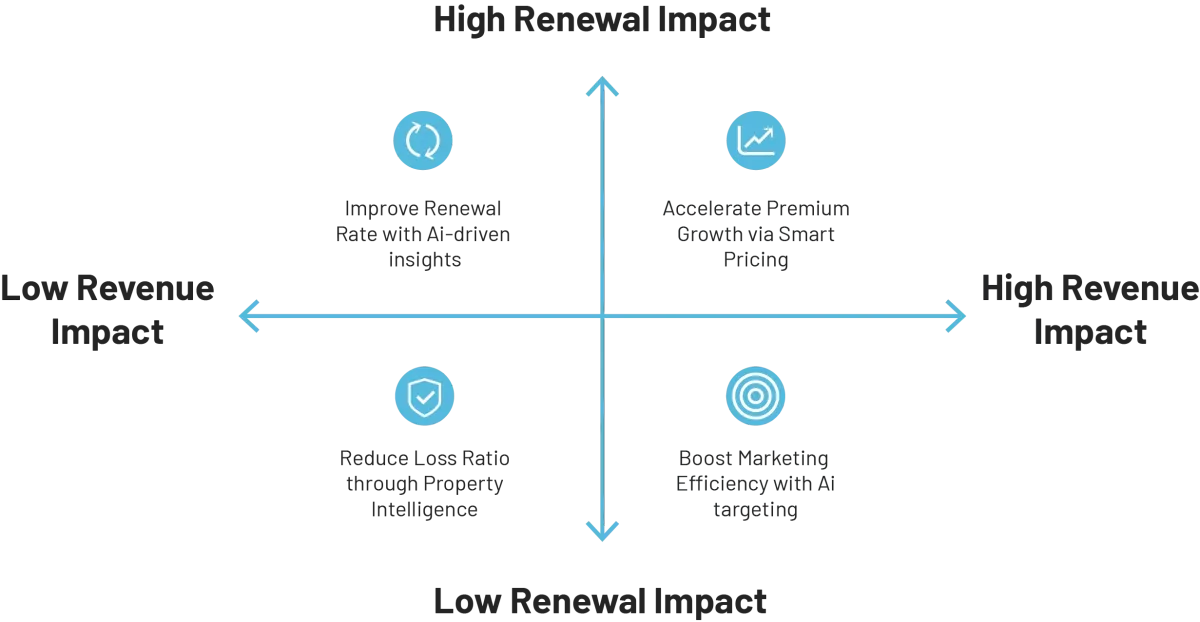

Scope Ai Solutions for Insurance

Use Cases & Value Stories

Retention – Home Warranty Provider

SellScope Ai flags households 90 days before a move; ProspectScope Ai targets for proactive outreach.

Impact: Modeled 15–20% renewal lift.

Marketing Efficiency – Auto & Home Bundle

PropsectScope Ai filters for confirmed homeowners with strong equity positions and high service-readiness scores, ensuring bundle offers go to the most likely convertors.

Impact: Modeled 22% higher bundle uptake rate and reduced CAC.

Risk Mitigation – P&C Carrier

Detect hail zones + aging roofs + cash-out refis to predict claim risk.

Impact: Projected 3-point loss ratio improvement.

Cross-Sell – Investor Policies

Identify landlords/flippers adding properties regularly.

Impact: Modeled 2× increase in multi-policy sales.

Scenarios based on modeled results using historical data patterns and industry benchmarks.

Why Scope Ai Wins for Insurance

Early-move detection to prevent churn.

Predictive risk assessment for better pricing.

Marketing efficiency through high-propensity targeting.

Investor intelligence for multi-policy cross-sell.

Nationwide coverage with no list stitching.

Privacy-compliant: no credit bureau data, no live tracking.

Recommended Pilot Structure

Implementation Steps

01

Define target geos and policyholder segments.

02

Receive encrypted files.

03

Deploy in retention, acquisition, and underwriting workflows for 30–60 days.

04

Measure renewal lift, premium growth, and loss ratio impact.

Retain More Policyholders. Write Better Risks. Grow Premiums Faster.

INDUSTRIES

How Else Can Leadflow Help?

Smarter Insurance Starts with Better Data

Reduce churn, price policies more accurately, and target high-value prospects with Ai-powered signals from Leadflow.